Alt Lending week ended 6th August 2021

Have mortgage lenders forgotten Deja vu?

Lucy Burton a rather attractive young Telegraph reporter warns the banks to be honest with their clients and begs those self same clients to recognise that the UK mortgage market is overheating. One of the advantages of being old is that you tend to have seen history repeating itself before. There is an almost dreadful inevitability that at some point there will be a downturn in property prices. It won’t matter because in large areas of the UK the only long terms term direction for prices is upward. The banks reaction to the perfect storm of scant availability and zero interest rates is the same as it has always been. First compete on interest rates and secondly compete on credit criteria. Once the banks are absolutely sure that they are truly over exposed they rein in their lending. This causes property prices to drop in the short term and makes matters even worse. Borrowers know this and added to the mix is the spectre of inflation which most millenials have never seen. Undoubtedly some first time buyers will overpay but the key will be the performance of the economy. In the meantime the same old cycle will keep on happening.

Monzo faces criminal and civil investigations over laundering allegations

It looks as if the FCA is taking a serious look at money laundering with some 42 investigations currently underway into both banks and individuals. On top of that there is the suspicion that many crypto currency platforms and brokerages are far from squeaky clean and are being used by many less than honest punters to hide their ill gotten gains. I am sure that most of us know this already and there is little surprise that digital newcomer Monzo is being investigated by the FCA. I am pretty sure that Monzo is no better or worse than any other player in the payments field but the key to spotting money laundering is to understand the underlying business transaction ie where the money comes from, where it is going to and why. Technology ought to have lot to offer to this field just by correlating information from disparate digital sources but there is always a need to employ people to take a close look at when unexplained gaps appear. Nevertheless I am pessimistic that we will ever cope with organised crime. Even when the corruption was out there in the open, Iceland and Cyprus come to mind, it was hard to get on top of it. My own guess is that so long as the fines are manageable the banks will be happy to do the bare minimum necessary to keep their licenses.

Best of luck to Nick Molnar and Anthony Eisen who have sold their BNPL app Afterpay to Square, Jack Dorsey’s company for $ 29 billion making it the biggest takeover in Australian history. It was founded in 2014 so one would presume that it does something really revolutionary: but it doesn’t. It is an app that simplifies the process of Buy now Pay later. The Telegraph story gives a little colour to the business model. Apparently the company charges a 4% commission on sales together with a fixed fee for something or other. But what is astonishing is that an app that has not invented anything new, has managed to sell itself at such a gargantuan price. Presumable Dorsey knows what he is doing and presumes the barriers to entry in BNPL are very high? I am afraid that I don’t see it and I don’t think I ever will. Installment credit which is what BNPL is as old as the hills. There are plenty of ways that it can be replicated. It all seems so simple. Add to that the fact that various financial regulators globally are taking a close look at the sector. The story doesn’t tell us whether Afterpay actually makes any money. That doesn’t seem important any more.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

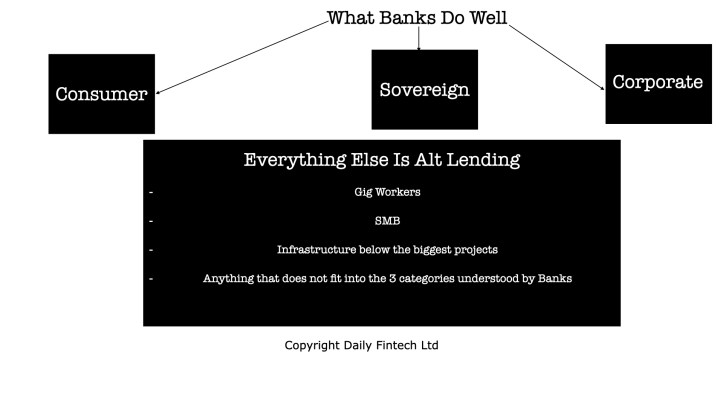

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.