Alt Lending week ended 3rd September 2021

Buy now pay later. (BNPL) Klarna leads the way, but to where?

The world of buy now pay later is expanding at a rapid rate and Klarna is at the forefront with all of the necessary attributes of a Fintech start up. Rapid client expansion, a stellar market valuation and heavy and increasing losses. Nevertheless the business model has been with us for donkeys years. Catalogues used to do this kind of stuff and send round agents to makes collections in person. This had the added advantage of knowing where somebody lived. It wouldn’t work now of course but what we are talking about is automation of a very basic function which scales because of technology. However as I have mentioned before regulators are opening their beady eyes to the growing loan losses incurred by Klarna and the rest of their cohort and can sense systemic risk, so some form of regulation is on the cards. I am no fan of regulation, largely because in general regulators in all fields, but particularly finance, are very good at wielding a huge sledgehammer to completely miss the nut. In the consumer credit area Regulation has been unsympathetic to lenders who have responded by being over aggressive to vulnerable consumers, usually poorer people, by charging eye watering interest rates to all its borrowers which more than covers their loan losses. So everybody ends up paying the bills. The same thing will happen with BNPL. It is hard not to feel some sympathy with the regulators who are simply trying to square a circle and will probably make nobody happy. As the “on the bridge at midnight” song goes. “it’s the same the whole world over it’s the poor what gets the blame it’s the rich what gets the pleasure ain’t it all a bloomin’ shame.

JP Morgan drops defence and oil stock on green grounds.

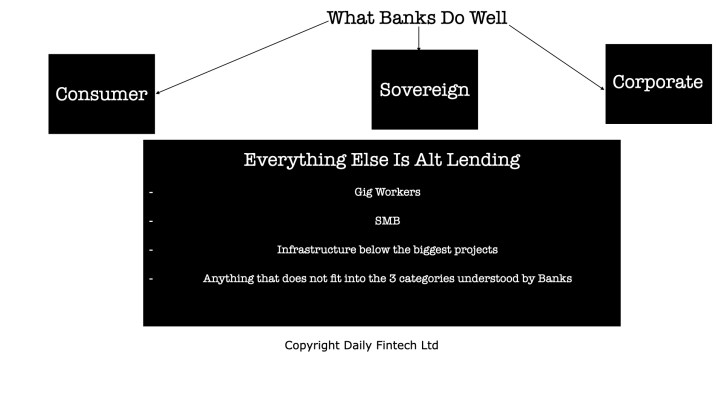

This story got global coverage and although it concerned JPM’s wealth management activities rather than it’s on balance sheet asset management it highlights the pressures that even very large companies are under to conform to green imperatives. Apparently JPM thinks that Facebook, a company with little moral compass is a better use of wealth than investing in companies that in general are at the cutting edge in green energy technologies and defence of the west. Well so be it. At the end of the day governments the world over have bailed out the banking sector and made it and its richer clients even more rich at the expense of poorer individuals. And we are all green now but saving the planet will always come second to putting food in bellies. Virtue signalling will just not cut it. The banking sector should stick to its knitting.

Sainsbury’s is to sell its banking arm to US private Equity firm

Not surprisingly UK grocery firm Sainsbury has decided to give up on its banking business. Also not surprisingly it takes a US private equity company to see the inherent value in the acquisition. I can’t help thinking that this is just a microcosm in a world where strong strategic thinking will always trump what looks like a slam dunk. Centerbridge partners has a strategic view driving its potential purchase which is based on a vibrant and, for the time being, very frothy UK Fintech sector. It intends according to Sky news to use the bank to acquire other banking platforms. Sainsburys was the first grocer to enter the financial services sector and has been in the business for nearly 25 years. They are suggesting that regulatory burdens are part of the problem. They usually are! My own view is that they should have done a lot better than they did and they are probably not going to get value for this sale either but that’s the way it goes. From Centerbridge’s point of view they are going to pursue making money and whether that is through building a business or selling a strategic view in a Fintech bull market who cares.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.