Alt Lending Week Ended 30th April 2021

Horta-Osorio awaits Greensill legal battle in Credit Suisse in tray

Quite a problem for the incoming Credit Suisse chairman. A group of investors who bought paper through Credit Suisse issued by Greensill capital is now considering a class action against CS for amongst other things mis-selling and misleading disclosure. So far CS has fired the Head of Investment Banking and the Head of Risk and compliance. It is like a chapter from Bonfire of the vanities. A couple of things strike me. There is obviously a question mark against whether the bank knew what Greensill was actually getting up to and the quality of the assets on its books. Words like reckless are being used. Pretty basic stuff actually. An action has already been filed in a US court alleging misleading investors and mismanaging risk. Greensill’s self styled activities were in Supply Chain Finance. This has been around for donkey’s years in the form of invoice factoring but Greensill took it to another level apparently lending against invoices that had not even been issued let alone accepted. There is a sense of déjà vu here. In the late 1980’s I arranged over £ 1 billion of CDO finance so I am familiar with the concept. The management of portfolio risk is not difficult but it does need attention to detail, plenty of due diligence, proper risk assessment and continuous monitoring. Investment banks are a bit like celebrity chefs cooking up meals that look very tasty but if they use toxic ingredients they do not get food poisoning: the investors however feel very sick indeed. Has anyone learned anything since 2008? Doesn’t look like it!

JP Morgan apologises for European Super league (ESL) fiasco

JP Morgan supremo Jamie Dimon clearly did not understand the PR disaster that would befall his bank following its decision to bankroll the failed ESP. It’s a bit late now but to be fair to him he is not the only one to look a bit over qualified this week. David Cameron obviously did not understand what he was doing lobbying for a company that was in deep financial difficulty. Neither did Credit Suisse’s management understand what is was into with the same company. Lending money does not need lots of technology particularly if you are in to larger amounts. But understanding simple things helps. What is the money going to be used for? How do we ensure that it is used for that specific purpose? Will this upset or hurt anybody else? How can we make sure that we get it back without embarrassment? On the last question the government is going to be on the hook for a mountain of bad debt on their COVID support facilities. I hope they have the answers.

Sovereign Debt and portfolio Management Issues

As Banks started to internationalise their businesses in the late 1960 they started to realise that some control should be exercised over their global exposures. I remember this well during my spells at Bankers Trust, Dresdner and BofA. The object of the exercise was, as usual, risk management and amelioration and it was important to the management of portfolios. Hence some kind of framework needed to be developed. This was recognised in spades during the sub prime crisis of 2008 where the United States exported a systemic collapse of its huge mortgage portfolio all over the world. The Telegraph today has a piece where Matthew Lynn points out that sovereign exposure is still important to investors everywhere. Since 2008 the printed money that so called advanced economies have been throwing around has ended up all over the place and while individuals may no longer feel that they are affected something nasty could be coming to your pension pot at any time as well as to your hedge fund or family office. Banks are of course not as important as they were in this regard, the ECB excepted. However it is vital to know where risk concentrations are and how they might affect you. In this piece Mr. Lynn points out that France is now the third biggest debtor in the world after the US and Japan but with one large difference that debt is held across the globe and is therefore more volatile that France, Spain and Greece despite the overall lower debt to GDP ratios.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

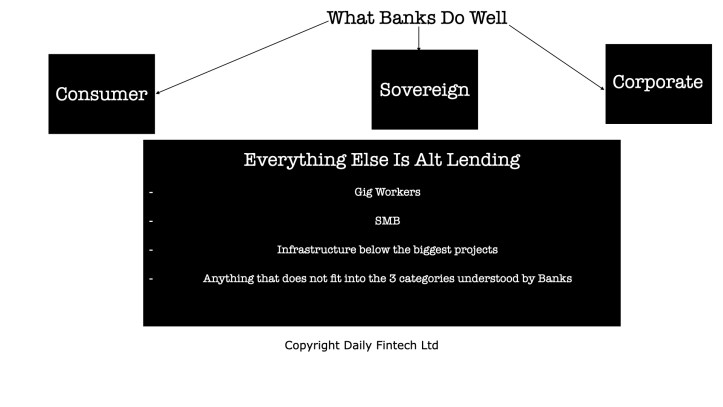

For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.