Alt lending week ended 2nd July 2021

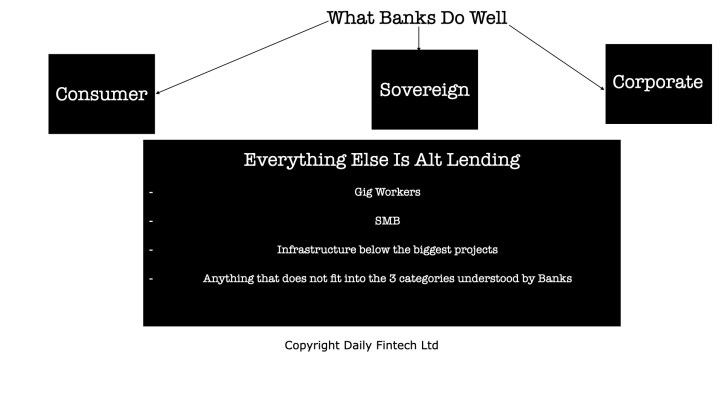

The Daily Telegraph’s City Correspondent , Ben Marlow cites the not untypical tale of Digital newcomer Revolut in his column of 22nd. June 2021. The interesting thing is that the same story seems to repeat itself across the whole of the digital banking sector. Revolut in many ways is a great success story having made penetrations into overseas markets including China, US and India and now has an impressive 14.5 million personal account holders. The problem is it doesn’t make any money and the latest result show a doubling of losses to a not insignificant £ 201 million last year. This despite an impressive 34% rise in revenues year on year. At the same time the big 5 UK market seem to be consolidating their position in the most critical retail market products. Attracting deposits it seems is something anybody can do but deploying the liabilities as revenue yielding assets doesn’t seem to be quite as easy. To be fair this whole conundrum precedes the digital era. We are left with volume based organisations relying on their brands. Investment banks that won’t get out of bed unless you either have or need a nine figure sum and precious little else. JP Morgan is jumping into this arena and looks like it will target the potentially lucrative personal wealth management market. As I’ve said before expect consolidation.

Zopa challenges Klarna in buy now, pay later sector

Welcome to a life on instalments. Challenger bank Zopa (where do they get these names from?) is gearing up to compete in the buy now, pay later space BNPL) dominated by Klarna. Apparently Zopa’s USP is consumer protection in the form of following the recommendations of the Woolard report, commissioned by the UK Financial Conduct Authority (FCA). Basically this report suggests that BNPL lenders become regulated entities. Growth in the sector during the pandemic has been stellar. The problem is that the client base are predominantly young, vulnerable and not good at budgeting. Klarna operates mainly in the clothing market and transaction sizes are relatively small around £ 60. Zopa intends to target the gadget market which has much higher transactional values. Two points to make. Firstly regulation always costs money and it is always consumers that pay for it. Secondly I recalled a few months ago a report by a challenger bank that one in 25 of its credit card transactions were being used by younger borrowers to pay off BNPL debt. The issuer of the report: Zopa! This is exactly the sector where transactional costs can be reduced through technology. I would have thought that transparency rather than regulation would be far more useful.

Biden Infrastructure Cash raises London based construction groups.

Markets are signalling that UK based construction firms are going to benefit from Mr. Biden’s $ 1 billion infrastructure splurge over the next eight years. Anyone who has visited the US over the last ten years cannot help but notice the dilapidated condition of some of its bridges, roads, airports, you name it. The fact is this is a worldwide phenomenon and it needs to be taken seriously or more bridges will collapse. The truth is that the more infrastructure is controlled by private investment the better off we will all be. Shipping is basic infrastructure almost entirely privately financed. Nobody bats an eyelid. The end result we get modern ships, enhanced design, greener outcomes etc. and little if any involvement by the government. The massive white elephant that is HS2 is a typical government project. It provides little benefit, stokes controversy, destroys environments, is a massive waste of resources, is over budget, will almost certainly be massively delayed, is old technology and will do nothing to help the UK’s competitiveness. Western democracies should have learned to do better but we haven’t. Infrastructure is there to solve problems. Capitalism is there to monetise it. Capital markets are there to facilitate it. That means not being lazy and justifying what we do in a consistent and sensible manner that doesn’t always fall on taxpayers or enrich chancers. If it doesn’t solve a problem or contribute to the bottom line or both then don’t do it. This is what banks used to do. What they do now is sell worthless government bonds that will never be repaid just inflated away. Heaven help us.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.