Alt Lending Week Ended 20th August 2021

Who are the regulators trying to protect?

The strange story of Amigo continues. I have commented on this before. Amigo is a company that provide(s) (d) loans for individuals with poor credit rating so long as they can find someone to provide a sufficiently creditworthy guarantor. This idea always looked problematic to me. A Guarantee is not security and in a lot of cases will need to be enforced. Not surprisingly the loans that Amigo made were not cheap featuring real rates of up to 50%. Come Covid, come the misselling claims. Compensation claims have ratcheted up and hundreds of thousand of individuals have valid claims. Amigo has been trying to square this with the UK courts and get the claims capped. So far without success. It also transpires that a couple of hedge funds have made loans to Amigo and the terms include the ability to take control of the company under defined circumstances including the publication of its accounts. The FCA wrote to Amigo muddying the waters hours before filing. Amigo delayed filing and was granted a dispensation to September 2nd. If the accounts are not filed by then the Hedgies will take control. The problem here is that many individuals will take a hit when the hedge funds will likely be repaid more or less in full. This begs the question: who are the regulators trying to protect and how did we get to this situation in the first place? Answers on a postcard please!

Banks should be able to shut existing branches if they are not profitable.

Chancellor Rishi Sunak is insisting that banks do not close branches when there is a social need. Writing in the same paper Matthew Lynn forensically destroys this argument. Firstly why do banks have to sustain branch networks that are not viable. Arguably part of the reason they are not viable is the rise of digital banking. The chancellor threatens sanctions against the existing banks thereby making it more difficult for the traditional banks to compete successfully with digital platforms. Lynn makes a valid point. If you are trying to solve a social problem then the government has to run it and pay for it being totally transparent about how much it is going to cost. This should be a reasonable approach and would allow a level playing field to develop. We need certain things like access to cash to enable the world to go around. But we do not provide subsidies to book shops or off licenses to enable access to books or wine. Why are we differentiating in favour of cash services? Sunak’s approach is ridiculous. He should rethink.

UK legal system’s relevance to Crypto technology

Barnabas Reynolds points out the advantages of British common Law when applied to Fintech particularly in the murky space of crypto assets. He contrasts the EU’s codified and controlled approach to the Uk’s more pragmatic and flexible approach considering the intentions of the participants and easily adapting to new innovation principally when it comes to the questions surrounding ownership. True Mr. Reynolds is a UK lawyer and is essentially drumming up business for his company but I think he is on to something. The integrity of the UK legal system has never been in doubt and the common sense approach to dispute solving is extremely important when electronic assets are flying around the globe at the speed of light. At the root of this premise is the fact that in most crypto based cases we are not dealing with physical assets but electronic ones that exist only virtually. Choice of law is quite key to determining the validity of ownership.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

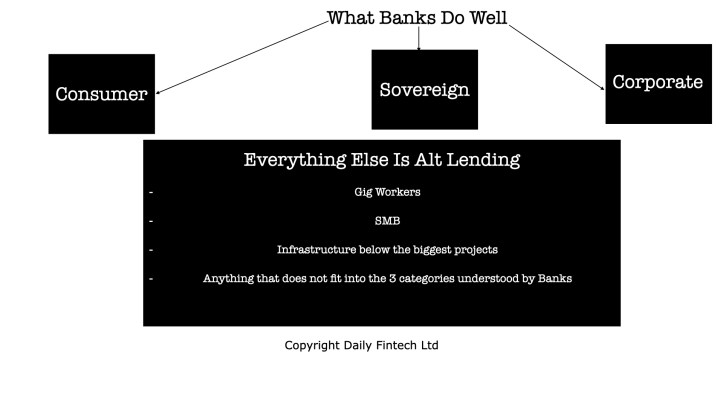

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.