Alt Lending week ended 16th July 2021

First of its kind LSE listing for Wise ought to be thought provoking?

Not surprisingly, this story has been widely reported for a couple of reasons. Firstly because it is the first time a listing in London does not involve the issuance of new shares, thereby saving considerable underwriting costs and placement costs and secondly because of the valuation itself. Based on the first days activity buyers hiked the value of Wise to an astonishing £ 8.8billion. Now this is a money transfer application. It sends money from one place to another, something banks used to do and before that we used registered letters and other non digital devices. I don’t want to speculate, but there is nothing new about it. Perhaps they give very keen FX rates and have other reasons why they should be this valuable.? There is no barrier to entry in this market and lots of people are doing it? What is so special about sending money from one place to another. One paper commented that at least WISE makes a profit having doubled its annual profits last year to £ 21.3 million. Unless I have miscalculated this translates to a mind blowing P/E ratio of 382:1. The conclusion seems to be that Wise compares well with other full digital banking offerings (that also do money transfers) but make considerable losses and are nowhere near as valuable. So what has this got to do with lending? If you can make more money by sending it from one place to another than by lending it profitably in productive assets then someone’s got their sums wrong.

UK mortgage price war looms as banks fight to keep market momentum

It seems like we can’t stop letting history repeat itself. A pricing war is now developing among the banking sector as the boom caused largely by Chancellor of the Exchequer Rishi Sunak’s stamp duty holiday comes to an end and prices start to cool down. God knows why we even have this appalling tax in the first place. It is government meddling at its very worst as it doesn’t help anybody. Nevertheless banks have only two things they can use to entice business. Firstly credit terms. They can lower deposit requirements. Secondly compete on pricing. If you lower deposit requirements then you increase the chances of negative equity should prices stabilise. Logically then interest rates should edge up to counter the enhanced risks. However low interest today will push prices higher which also increases risk. One thing is certain properties in certain parts of the UK are no longer affordable. Inflation is rising and it is glib to say that interest rates will not rise as the whole thing is transitory. The government cannot afford to allow rates to rise but because of their other priorities and interventions are powerless to stop it. Interest rates have been a politicised for too long. I am not sure there is a satisfactory answer?

Auditors PwC and Saffery Champness under scrutiny concerning Greensill and Wyelands Bank

At least someone is having a look at what went on earlier this year. Certainly the house of cards that was Greensill capital was, with hindsight, an accident waiting to happen as I have mentioned in the column previously. I don’t suppose for an instant that this is really going to help anybody and might cause PI insurers some sleepless nights but will it lead to an improvement in audit quality. I doubt it. I was a lending banker from 1969 to 1987. I was taught to understand accounting myself and to ask questions. At Bankers Trust I penned a controversial memo which foresaw by two years the debacle that Clarksons and Court Line. At the time it caused an internal furore but in those days even a junior analyst had to be taken seriously. The warning signs generally appear well in advance but it takes expertise to pick up on them. That skill set is a rarity these days.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

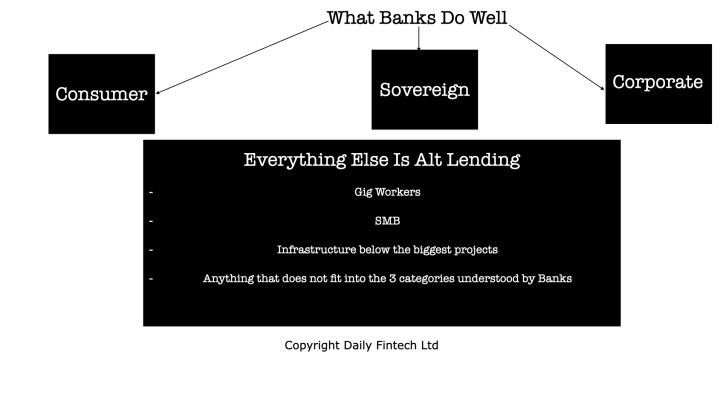

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.