Alt Lending Week Ended 16th April 2021

Interesting piece in the right wing flagship magazine Spectator. Ross Clark makes the valid point that the glacially slow roll out of COVID vaccinations in mainland Europe are forcing some major European economies to shutdown again when this is exactly what they had hoped to avoid. This is exacerbating a disturbing trend in that the European banking systems have increased their exposures in assets issued by their own governments by £ 140billion over the last twelve months to an eye-watering £ 2.1 trilllion. He also quite rightly points out that the European sovereign debt crisis which began in 2010 never really went away and was patched up by a series of less than totally effective measures. This will be very important as the EU tries to dig itself out of the COVID hole. A banking system compromised by its own sovereign dept is not going to help and will undoubtedly spell more trouble before it is all over.

Zombie Companies should be allowed to die says ex BofE governor Lord King

This is not a new problem for the UK, or for anywhere else, come to that but the artificial support that COVID support facilities have provided arguably makes the situation worse than ever. His central point that next to zero interest rates have allowed companies to survive when they should have collapsed. He is right. But then along came COVID and all the support they needed was forthcoming and at rather good terms. A day of reckoning approaches when the life support machine is switched off. The problem for economies will be, not to throw out the baby with the bathwater. The COVID facilities have, in the UK, been distributed by commercial banks and the bad debt will come close to overwhelming them. This includes the digital start ups. I foresee a messy situation developing with politicians doing what they do best trying to blame everybody else.

David Cameron’s Greensill Escapade Is a Sorry Tale

Undoubtedly the biggest financial scandal to have emerged from COVID has been the Greensill debacle which has cost some of the key players dear. Although no laws appear to have been broken the entanglement of Aussie entrepreneur Lex Greensill and ex Prime Minister David Cameron just doesn’t seem Kosher. Cameron apparently lobbied for financial assistance for Greensill with the UK treasury. There are lessons to learned here. So far one of the big losers Credit Suisse has fired the Head of investment Banking and the Head of Risk and Compliance (strange title). With Greensill an apparent (euphemistic) supply chain financing house it looks increasingly likely that a lot of the loans made did not support supply chains at all but were used to fund acquisitions and other activities. KYC is meant to mean that you know what your clients are doing with your money doesn’t it. Ignorance is not an excuse and nor is being in compliance. Not understanding the risk as a banker is unforgiveable.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

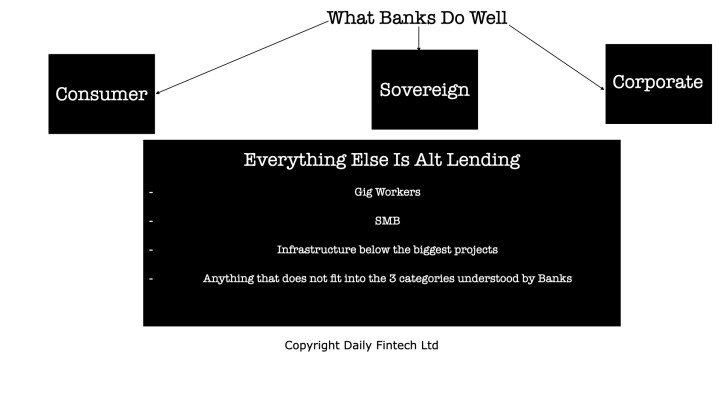

For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could